Table of Contents

The FIRE (Financial Independence, Retire Early) movement is a lifestyle movement that has gained significant momentum in recent years. It’s focused on achieving financial independence and the option to retire much earlier than traditional retirement ages. Here’s a detailed look at the FIRE movement, including its history, definition, variants, advantages, and criticisms.

History of the FIRE Movement

The roots of the FIRE movement can be traced back to the 1992 best-selling book “Your Money or Your Life” by Vicki Robin and Joe Dominguez. This book introduced the concept of measuring expenses and savings in terms of life energy rather than just dollars, encouraging readers to seek financial independence to reclaim their time and life.

However, the actual term “FIRE” gained prominence in the early 2010s with the rise of personal finance blogs and forums where individuals shared their experiences and strategies for achieving early retirement. The global financial crisis of 2007-2008 also played a significant role, as it led many to question traditional career paths and retirement plans.

What is FIRE?

FIRE revolves around a simple principle: save and invest aggressively in the early years of your career so that you can retire much earlier than the typical retirement age of 65. The idea is to accumulate assets that generate enough passive income to cover living expenses indefinitely. Proponents of FIRE typically aim to save at least 50% of their income, far above the average savings rate which hovers between 3-5%.

Variants of FIRE

- Lean FIRE: This involves living a minimalist lifestyle and retiring with a smaller nest egg. Adherents to Lean FIRE typically focus on reducing expenses to the bare minimum.

- Fat FIRE: Opposite to Lean FIRE, this approach involves saving a larger nest egg to maintain a more comfortable or luxurious lifestyle in retirement.

- Barista FIRE: Individuals following this variant plan to retire early from their main career but continue to work in a part-time job, often for reasons like health insurance benefits or social engagement.

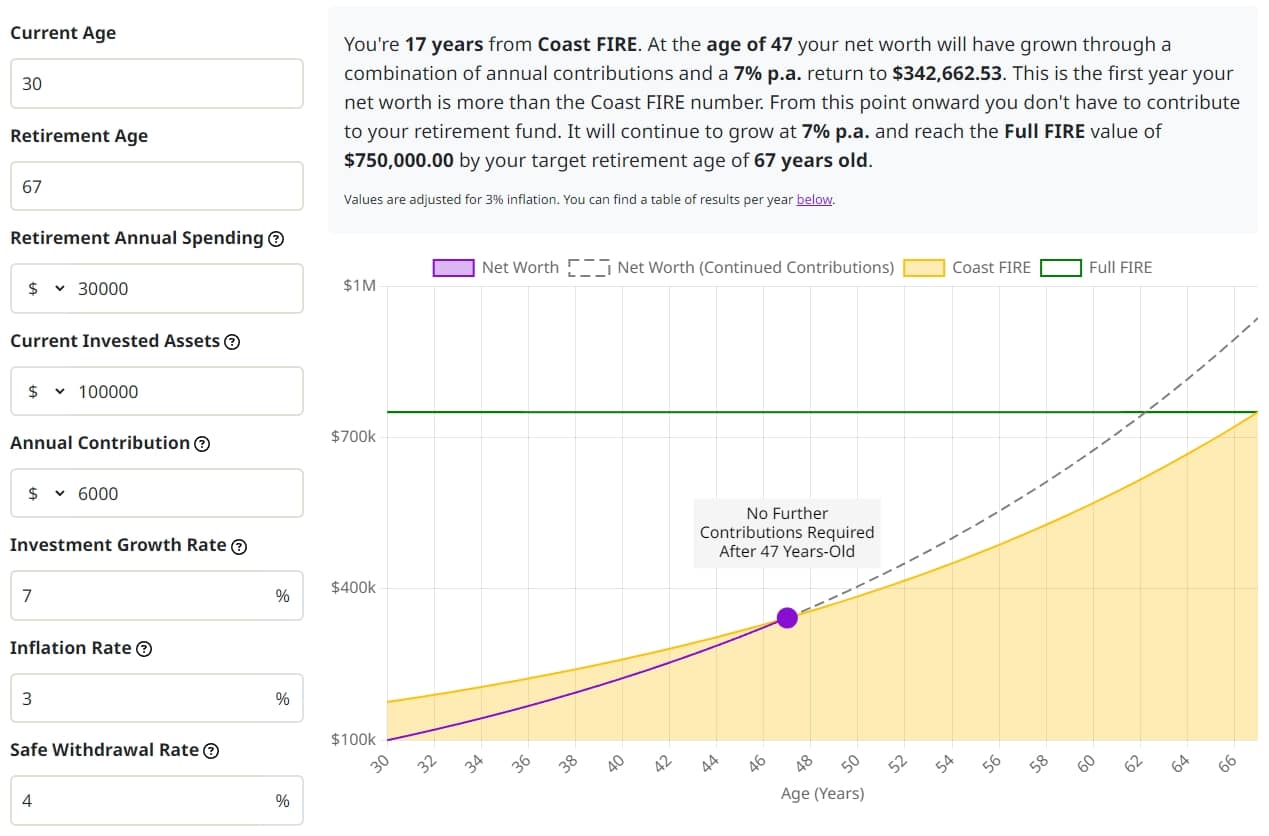

- Coast FIRE: This involves saving enough money early in life so that you no longer need to save for retirement, but you continue working to cover current living expenses until the traditional retirement age.

Coast FIRE is fast becoming the most popular variant of FIRE on account of how easy it is to achieve. You can model your own Coast FIRE scenarios using our Coast FIRE calculator.

Advantages of FIRE

- Financial Security: Achieving financial independence provides a significant safety net against economic downturns or personal misfortunes.

- Flexibility and Freedom: Early retirement allows individuals more time to pursue their passions, travel, or simply enjoy life without the constraints of a full-time job.

- Health and Well-being: The stress reduction from not having to work can have a positive impact on both physical and mental health.

- Empowerment and Control: FIRE encourages taking control of one’s financial future, promoting financial literacy and responsible money management.

Criticisms of FIRE

- Not Feasible for Everyone: Critics argue that the FIRE movement is only accessible to those with high incomes and overlooks the financial struggles of lower-income individuals.

- Risk of Underestimating Needs: There is a risk that individuals may underestimate their financial needs in retirement, particularly with longer life expectancies and potential unforeseen expenses.

- Quality of Life Concerns: Some suggest that the extreme frugality required to achieve FIRE may lead to a lower quality of life.

- Economic Impact: There’s a debate about the potential macroeconomic impact if a significant portion of the population retires early, such as reduced workforce participation and consumer spending.

- Mental Health Risks: Retiring early without a clear plan can lead to feelings of aimlessness or loss of purpose for some individuals.

Conclusion

The FIRE movement presents an intriguing approach to personal finance and retirement planning, emphasizing aggressive saving and investing to achieve financial independence. While it offers several advantages, such as financial security and lifestyle freedom, it also faces criticisms regarding its feasibility and potential risks. As with any financial strategy, individuals need to consider their unique circumstances and long-term goals before pursuing FIRE.